.

.

.

.

.

.

.

AI and HPC are having a major impact on financial markets in many different areas including:

· Blockchain

· Wealth Management

· High Frequency and Algorithmic Trading

· Compliance

· Equities and other Recommender Systems

· Derivatives Pricing

· Simulation

· Analytics and Big Data – reducing the footprint and operating costs

Blockchain

High Performance Computing is essential for many aspects of Blockchain processing especially as volumes increase.

Blockchain’s distributed and decentralised storage of data offers scope for shared storage of other private information and introduction of smart contracts will have significant impact on transactions between organisations such as settlement.

Wealth Management

AI recommender systems can provide personalised recommendations to high net worth individuals. These systems take market intelligence, a complete analysis of individual portfolios and the historic investment strategy to customise recommendations. Not only are recommendation personalised but the speed of GPU-accelerated means that the frequency of these personalised recommendations can be significantly increased yielding higher levels of customer retention.

Many of the latest AI Voice to text to Speech systems are so effective that customers are not aware that they have been conversing with a machine. Low-latency AI conversions mean that systems can convert speech to text, interpret the text, research a response and translate this to speech in fractions of a second. As such real time personalised investment and portfolio recommendations are already possible.

High Frequency and Algorithmic Trading

High Frequency Trading has demanded High Performance Compute solutions for many years where the difference in performance of the network card and processor is critical to the business.

As we move into the era of Artificial Intelligence and Algorithmic trading systems high performance computing is more important than ever to gain an edge over your competitors.

In an effort to gain an edge many application developers are leveraging GPU-accelerated compute systems and other compute accelerator cards to reduce the processing time of critical functions within the trading applications. Many software developers have experienced a 10X-100X improvement in processing times.

We have high-performance GPU-accelerated systems featuring high-speed network cards commonly used in trading systems (like the Solarflare).

Compliance

Since the 2008 financial crisis regulation in Banking and Finance has grown exponentially. Anti-money laundering programs, sanctions lists and new industry and government regulations impose significant monitoring costs on the organisation.

NLP (Natural Language Processing) allows AI to monitor compliance against finance and banking industry standards and government regulations replacing the need for many specialist employees. Compliance is actively monitored by AI and the specialist compliance officers are freed up to examine anomalies.

NLP (Natural Language Processing) allows AI to monitor compliance against finance and banking industry standards and government regulations replacing the need for many specialist employees. Compliance is actively monitored by AI and the specialist compliance officers are freed up to examine anomalies.

Machine learning based recommender systems for investment products can propose investment ideas in a similar way that Netflix makes recommendations on your viewing.

Recommenders can consider each investor separately and provide customised recommendations based upon their existing portfolio, risk profile, trading history, market volatility, current prices and more. What is more these recommendations can be made in real time considering the current news, pricing and current portfolio performance.

Many of these systems are based upon deep learning and continually improve the quality of recommendations.

These immediate, personalised and current recommendations improve service, frequency of client contact and build client loyalty. They can be combined with artificial intelligence for voice and speech processing to extend these systems to proactive contact with clients when alert conditions are triggered.

Derivatives Pricing

Deep Learning models have been developed to take pricing information and based upon training determine what happens next. These predictions are free of human emotion and bias and can be fed into options and other pricing models.

JP Morgan has adopted Deep Learning technology for Hedging finding the AI developed “deep hedging” strategies outperformed human-developed strategies. JP Morgan then began using the self-taught algorithms to hedge some of its vanilla index options portfolios. The bank plans to roll out Deep Learning technology for hedging single stocks, baskets and light exotics.

Simulation

High-performance compute and artificial intelligence can be used to model entire markets and then rapidly refresh models often in near real time.

UK bank NatWest has invested heavily in AI to simulate financial markets, transport networks and other environments and then use the information to spot risks and opportunities.

UK bank NatWest has invested heavily in AI to simulate financial markets, transport networks and other environments and then use the information to spot risks and opportunities.

Analytics and Big Data

The massive growth in the volume of data being collected by businesses has created massive multi-node systems for processing and storing this data. Operating costs for both cloud-based systems and private clouds are growing exponentially as the volume of data grows. Costs for moving this data between clouds have also grown exponentially.

Most of the largest organisations have already migrated to a Hybrid cloud solution where public cloud and private cloud (compute and storage located in the organisation’s own datacentre) coexist. A large percentage of workloads will be moved to private cloud because of cost, data security and performance.

GPU-enabled compute reduces the physical footprint of the compute nodes by massively consolidating these compute servers into one or more powerful compute systems. A high-end high-performance computer can replace 100 CPU-powered compute nodes. This reduces space requirements and also cuts power and other operating infrastructure costs dramatically.

GPU-Accelerated Applications

Nvidia maintains a list of many finance and trading applications already supporting GPU-acceleration.

|  |  |  |  |

Many financial

organisations already develop in languages including C++ and Python or even

with Matlab libraries. These languages and many more are ready to take

advantage of GPU-acceleration. Optimising performance-critical parts of the

code can have dramatic (10X or even 100X) improvements in performance.

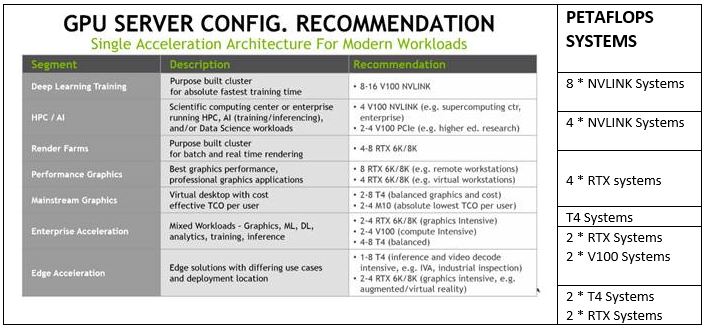

GPU Accelerated Hardware

Petaflops

specialises in providing High Performance GPU-accelerated hardware for business

High Performance Compute and Artificial Intelligence.

We have

systems suitable for pilots available for under $75000. Please call us on 1300

00 8100 to discuss or explore the products we have online here.

Highest performance systems are built from the

ground up for multiple GPUs. Low-power consumption GPUs may be retrofitted into

existing industry-standard servers to achieve moderate performance.

HPC Compute servers

HPC Compute servers

GPUs for retrofitting in existing servers

Storage servers

High Density storage is also required for business. The major vendors provide systems with many petabytes available across multiple nodes with full redundancy. For smaller requirements there are 30 and 60 drive systems capable of storing 0.5-1.0PB (500TB-1000TB).

Storage servers

High Density storage is also required for business. The major vendors provide systems with many petabytes available across multiple nodes with full redundancy. For smaller requirements there are 30 and 60 drive systems capable of storing 0.5-1.0PB (500TB-1000TB).

Data Science Workstations

.

.

.

.

.

.

.

.